RegTech has completely transformed how businesses handle compliance in 2025, with automation reducing costs by 30% and improving operational efficiency by 50% across various sectors. The market is experiencing explosive growth as companies shift away from unsustainable manual processes toward AI-powered solutions that can handle the 300+ regulatory updates financial institutions face annually.

Key Takeaways

- The global RegTech market is growing at 12-15.5% CAGR through 2030, with the U.S. market specifically expanding at 20.75% CAGR

- AI and machine learning will power 85% of compliance processes by 2026, reducing manual labor by 35%

- Automated AML monitoring cuts false positives by 40-60%, dramatically reducing investigation costs

- Legacy system compatibility remains a major implementation barrier for 45% of firms

- Emerging solutions like generative AI are creating auto-generating compliance manuals tailored to regional regulations

The Compliance Revolution: RegTech in 2025

The compliance landscape has undergone a radical transformation in 2025. With financial institutions now facing over 300 regulatory updates annually, traditional manual approaches have become completely unsustainable. This shift explains why the global RegTech market is projected to grow at a 12-15.5% CAGR from 2025 to 2030, with the U.S. market specifically expanding at an even more impressive 20.75% CAGR through 2033.

Compliance automation now delivers measurable results that executives can’t ignore. Modern RegTech solutions reduce costs by 30% while improving operational efficiency by 50% compared to manual processes. I’ve seen firsthand how these technologies transform compliance from a cost center into a strategic advantage for businesses across sectors.

This comprehensive RegTech compliance automation guide examines how these technologies are reshaping regulatory compliance while delivering substantial ROI for adopters. The shift from reactive to proactive compliance represents a fundamental change in how businesses approach regulatory requirements.

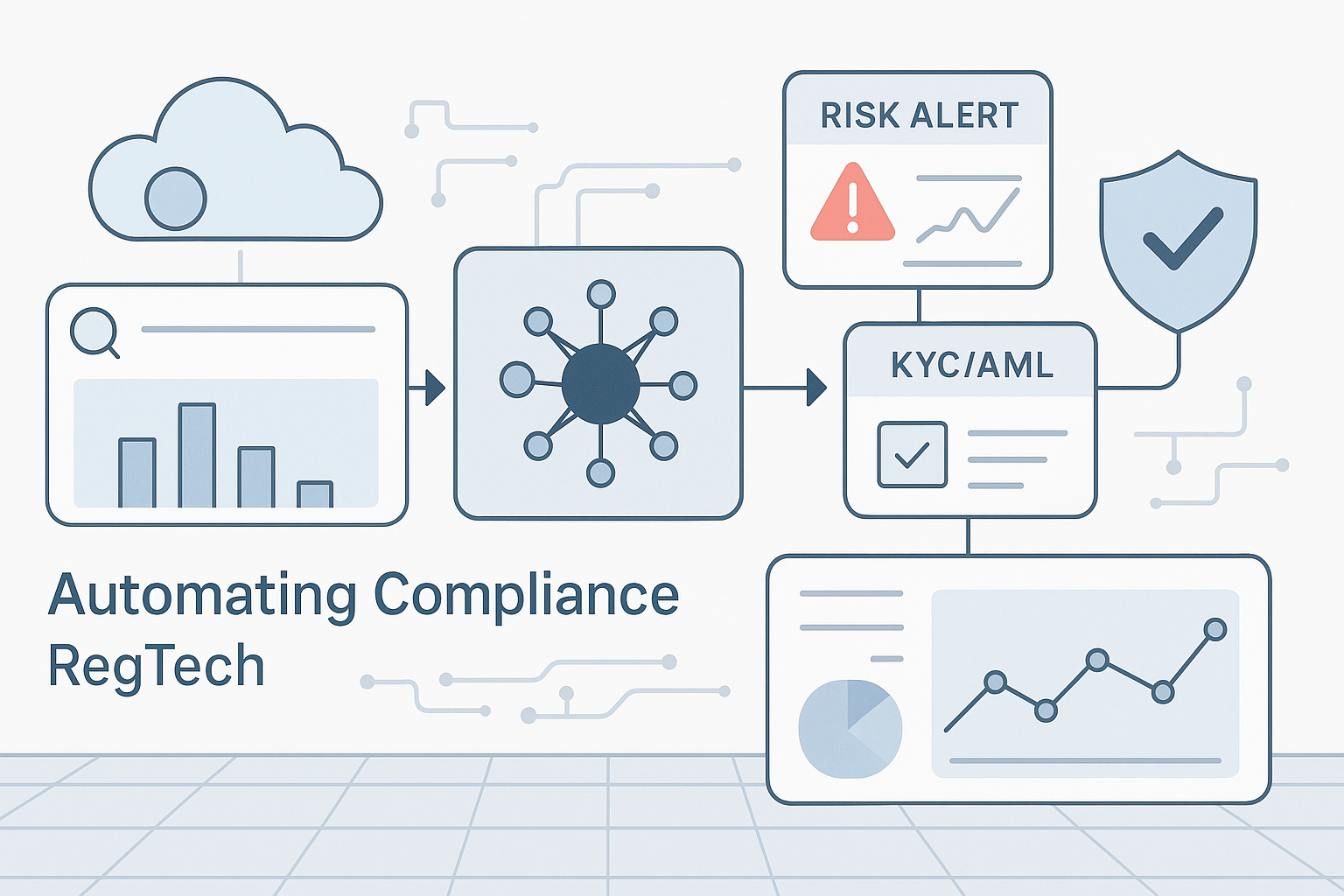

Core Technologies Transforming Compliance

Several key technologies are driving the RegTech revolution in 2025. According to industry projections, AI and machine learning will power 85% of compliance processes by 2026, representing a massive shift from human-centered approaches to automated systems.

Generative AI has emerged as a game-changer, reducing manual labor by 35% through its ability to automatically generate policy updates and audit reports. These systems can analyze vast regulatory texts and translate complex requirements into actionable compliance protocols.

Blockchain technology provides another critical advancement through tamper-proof record-keeping that reduces reconciliation errors by an impressive 90%. This creates an immutable audit trail that satisfies even the strictest regulatory requirements.

The infrastructure supporting these solutions predominantly relies on cloud platforms, with giants like:

- Microsoft Azure

- AWS

- Google Cloud

Big Data analytics tools now process petabytes of transaction data, improving fraud detection accuracy by 80%. These platforms can identify suspicious patterns that would be impossible for human analysts to detect manually, creating a much more effective compliance shield.

Measurable Benefits for Business Adoption

The business case for RegTech adoption has never been stronger. AML monitoring automation now reduces false positives by 40-60%, dramatically cutting investigation costs that previously consumed massive compliance resources. This improvement alone justifies implementation for many financial institutions.

Customer experience also benefits substantially, with AI-driven tools resulting in 50% faster KYC onboarding processes. This acceleration creates competitive advantages while maintaining regulatory compliance.

The financial impact extends beyond operational improvements. Automated compliance cuts operational costs by 30% and reduces regulatory fines by 45% through more consistent application of rules. According to data from Thomson Reuters, their compliance tools save firms approximately $2.5M annually in manual review costs.

Machine learning platforms like Apiax reduce interpretation errors by 70%, ensuring that compliance decisions are based on accurate regulatory understanding rather than potentially flawed human judgment. This consistency is particularly valuable in complex regulatory environments where requirements frequently change.

Implementation Challenges and Solutions

Despite the clear benefits, RegTech implementation isn’t without challenges. A significant 45% of firms cite legacy system compatibility as their primary adoption barrier. The solution lies in modular frameworks from consultancies like Deloitte and API-driven platforms such as Fenergo that enable phased integration without wholesale system replacement.

User adoption presents another hurdle, with 60% of compliance teams struggling with complex interfaces. Low-code platforms from providers like Ascent Technologies address this by allowing non-technical staff to build custom dashboards tailored to their specific needs and technical comfort level.

Successful implementations often follow these proven approaches:

- Starting with focused use cases rather than comprehensive replacement

- Emphasizing user training with practical application scenarios

- Implementing proper AI tool training to improve adoption rates by 55%

- Creating cross-functional implementation teams with both technical and compliance expertise

Leading RegTech Solutions for 2025

Several standout solutions have emerged as market leaders in the 2025 RegTech landscape. ACA ComplianceAlpha® has gained traction for its ability to automate governance workflows and generate audit-ready reports that satisfy regulators across jurisdictions.

For transaction monitoring, Actico Compliance Suite uses advanced machine learning to analyze millions of daily transactions, cutting compliance workload by an impressive 75%. This efficiency gain allows compliance teams to focus on high-value analysis rather than routine screening.

Thomson Reuters Regulatory Intelligence has become essential for many organizations by automatically updating compliance checklists based on real-time regulatory changes. This capability ensures that businesses remain compliant even as regulations evolve rapidly.

For financial crime detection, SAS Anti-Money Laundering employs sophisticated network analytics to identify suspicious patterns and relationships that traditional rule-based systems would miss. Meanwhile, IBM OpenPages has carved out a leadership position in ESG reporting and operational risk management as these areas face increasing regulatory scrutiny.

Regulatory Priorities Shaping Technology Needs

The regulatory landscape continues to evolve, driving specific technology requirements. The EU’s AI Act now mandates transparency in automated decision-making tools like IBM Watson Regulatory Compliance, requiring explainable AI models that can articulate their reasoning.

GDPR and CCPA penalties have increased 25% year-over-year, making automated data mapping and consent management tools like OneTrust increasingly important. These solutions provide the granular control needed to satisfy complex privacy requirements.

RegTech solutions must now document AI model training data and bias mitigation strategies to satisfy regulatory requirements. This documentation requirement reflects growing concerns about algorithmic fairness and potential discrimination in automated systems.

Cross-border compliance has become significantly more complex and technology-dependent as regulatory fragmentation continues. Solutions that can navigate these differences automatically provide substantial value for multinational operations.

Implementation Strategy for Businesses

Successful RegTech implementation requires a structured approach. I recommend starting with a thorough risk exposure assessment by auditing existing workflows to identify automation priorities. This assessment should consider both compliance risk and operational inefficiency.

When selecting solutions, prioritize scalability. Platforms like Snowflake’s Data Cloud can handle growing data volumes as your compliance requirements expand. This scalability prevents the need for disruptive replacements as your business grows.

Consider partnering with specialized vendors like PwC for workshops on AI-driven compliance. These partnerships provide valuable expertise that accelerates implementation and improves adoption rates across your organization.

Technical integration capabilities should be a primary selection criterion. Solutions with strong API capabilities connect siloed databases more effectively, creating a unified compliance view. This integration is essential for accurate reporting and comprehensive risk management.

I’ve found that modular approaches for phased implementation minimize disruption while still delivering meaningful benefits. This approach allows businesses to tackle their most pressing compliance challenges first while building toward comprehensive automation.

Future Trends Reshaping Compliance

Looking ahead, several emerging trends will further transform compliance automation. Generative AI tools like ChatGPT-5 are now auto-generating compliance manuals aligned with regional laws, eliminating much of the tedious documentation work previously required.

Real-time regulatory update platforms integrated directly with government databases provide immediate notification and interpretation of new requirements. This integration eliminates the delay between regulatory changes and compliance implementation.

RegTech is expanding beyond its financial services origins, with cross-industry expansion driving 20% sector growth in healthcare and crypto compliance. These sectors face increasing regulatory scrutiny that traditional approaches can’t address effectively.

Cloud-native solutions now support enterprises managing more than 50 global regulations simultaneously. This capability is essential for multinational organizations navigating complex and sometimes contradictory requirements across jurisdictions.

Tools like Actico’s Compliance Suite enable a 75% reduction in compliance workload through intelligent automation. This efficiency gain allows compliance teams to shift from routine monitoring to strategic risk management, creating more value for their organizations.

Sources

wealthsolutionsreport.com – RegTech Surge: What to Expect in RegTech for 2025

dbmaestro.com – The Role of Database Automation in RegTech Compliance

globenewswire.com – The World Market for RegTech 2025-2030

symphonyai.com – 2025 RegTech Trends: AI Mainstream

imarcgroup.com – United States RegTech Market

1 comment

[…] specific needs, whether they’re small credit unions or global banking conglomerates. The fundamentals of compliance automation remain consistent across implementations, but customization options allow for targeted […]